Here is the statistics class problem (and solutions) covered during today’s meeting of Finance 4366:

This week in Finance 4366

This week, we will cover a two-part statistics tutorial based on the Statistics Tutorial, Part 1 and Part 2 lecture notes (items 3 and 4 on the Lecture Notes page).

Due tomorrow (1/23):

- Readings listed for January 23 on the Readings page,

- Quiz 2 (Based on these readings), available from https://baylor.instructure.com/courses/197736/quizzes/374530.

- Problem Set 1 (Based on the Math tutorial last Thursday, available as item 2 on the Problem Sets page); turn in at https://baylor.instructure.com/courses/197736/assignments/1913981.

Finance: Insights into its meanings, etymology, and more from the Oxford English Dictionary

Kudos to my colleague Dr. Seward for bringing to our attention the many fascinating historical perspectives on the word “Finance” which appear in the Oxford English Dictionary:

Finance in the Oxford English DictionaryTo download this PDF document, click here.

On the ancient origin of the word “algorithm”

The January 24th assigned reading entitled “The New Religion of Risk Management” (by Peter Bernstein, March-April 1996 issue of Harvard Business Review) provides a succinct synopsis of the same author’s 1996 book entitled “Against the Gods: The Remarkable Story of Risk“. Here’s a fascinating quote from page 33 of “Against the Gods” which explains the ancient origin of the word “algorithm”:

“The earliest known work in Arabic arithmetic was written by alKhowarizmi, a mathematician who lived around 825, some four hundred years before Fibonacci. Although few beneficiaries of his work are likely to have heard of him, most of us know of him indirectly. Try saying “alKhowarizmi” fast. That’s where we get the word “algorithm,” which means rules for computing.”

Rules for calculating (math) derivatives

Origin of the “Product Rule”, and Visualizing Taylor polynomial approximations

This blog entry provides a helpful follow-up for a couple of calculus-related topics that we covered during today’s Mathematics Tutorial.

- See page 12 of the above-referenced lecture note. There, the equation for a parabola (

) appears, and the claim that

is corroborated by solving the following expression:

In the 11-minute Khan Academy video at https://youtu.be/HEH_oKNLgUU, Sal Kahn takes on the solution of this problem in a very succinct and easy-to-comprehend fashion.

In the 11-minute Khan Academy video at https://youtu.be/HEH_oKNLgUU, Sal Kahn takes on the solution of this problem in a very succinct and easy-to-comprehend fashion. - In his video lesson entitled “Visualizing Taylor polynomial approximations”, Sal Kahn replicates the tail end of today’s Finance 4366 class meeting in which we approximated y = ex with a Taylor polynomial centered at x=0 (as also shown in pp. 18-23 of the Mathematics Tutorial lecture note). Sal approximates y = ex with a Taylor polynomial centered at x=3 instead of x=0, but the same insight obtains in both cases, which is that the accuracy of Taylor polynomial approximations increases as the order of the polynomial increases.

On the relationship between the S&P 500 and VIX

Besides reviewing the course syllabus during the first day of class on Tuesday, January 16, we will also discuss a particularly important “real world” example of financial risk. Specifically, we will study the relationship between realized daily stock market returns (as measured by daily percentage changes in the SP500 stock market index) and changes in forward-looking investor expectations of stock market volatility (as indicated by daily percentage changes in the CBOE Volatility Index (VIX)):

As indicated by this graph (which also appears in the lecture note for the first day of class), daily percentage changes in closing prices for the SP500 (the y-axis variable) and the VIX (the x-axis variable) are strongly negatively correlated with each other. The blue dots are based on 8,574 contemporaneous observations of daily returns for both variables, spanning 34 years starting on January 2, 1990, and ending on January 12, 2024. When we fit a regression line through this scatter diagram, we obtain the following equation:

,

where corresponds to the daily return on the SP500 index and

corresponds to the daily return on the VIX index. The slope of this line (-0.1147) indicates that on average, daily closing SP500 returns are inversely related to daily closing VIX returns. Furthermore, nearly half of the variation in the stock market return during this period (specifically, 48.87%) can be statistically “explained” by changes in volatility, and the correlation between

and

during this period is -0.70. While a correlation of -0.70 does not imply that daily closing values for

and

always move in opposite directions, it does suggest that this will be the case more often than not. Indeed, closing daily values recorded for

and

during this period moved inversely 78% of the time.

You can also see how the relationship between the SP500 and VIX evolves prospectively by entering http://finance.yahoo.com/quotes/^GSPC,^VIX into your web browser’s address field.

Required Text Materials in Finance 4366

The required textbook for the Options, Futures, and Other Derivatives (Finance 4366) course at Baylor University (coincidentally) shares the same title as the course.

Although I list the 11th (US) edition as “required” for Finance 4366 in the course syllabus, earlier editions of this book, e.g., the 8th, 9th, and 10th (US and international) editions, will also suffice since the chapters we cover in Finance 4366 are virtually identical across the 8th through 11th editions. When you make your purchase, make sure that the book author (John C. Hull) and title (Options, Futures, and Other Derivatives) are the same, that the edition of the book is no earlier than the 8th edition, and that you are buying the textbook and not the solutions manual or instructor’s manual.

Finally, don’t worry about whether the book you buy or rent includes the “Derivagem” software. Derivagem is an Excel-based Options Calculator and Applications Builder you can download Professor Hull’s website at https://www-2.rotman.utoronto.ca/~hull/software/DG400a.zip.

The 17 equations that changed the course of history (spoiler alert: we use 4 of these equations in Finance 4366!)

I especially like the fact that Ian Stewart includes the famous Black-Scholes equation (equation #17) on his list of the 17 equations that changed the course of history; Equations (2), (3), (7), and (17) play particularly important roles in Finance 4366!

From Ian Stewart’s book, these 17 math equations changed the course of human history.

Calculus and Probability & Statistics recommendations…

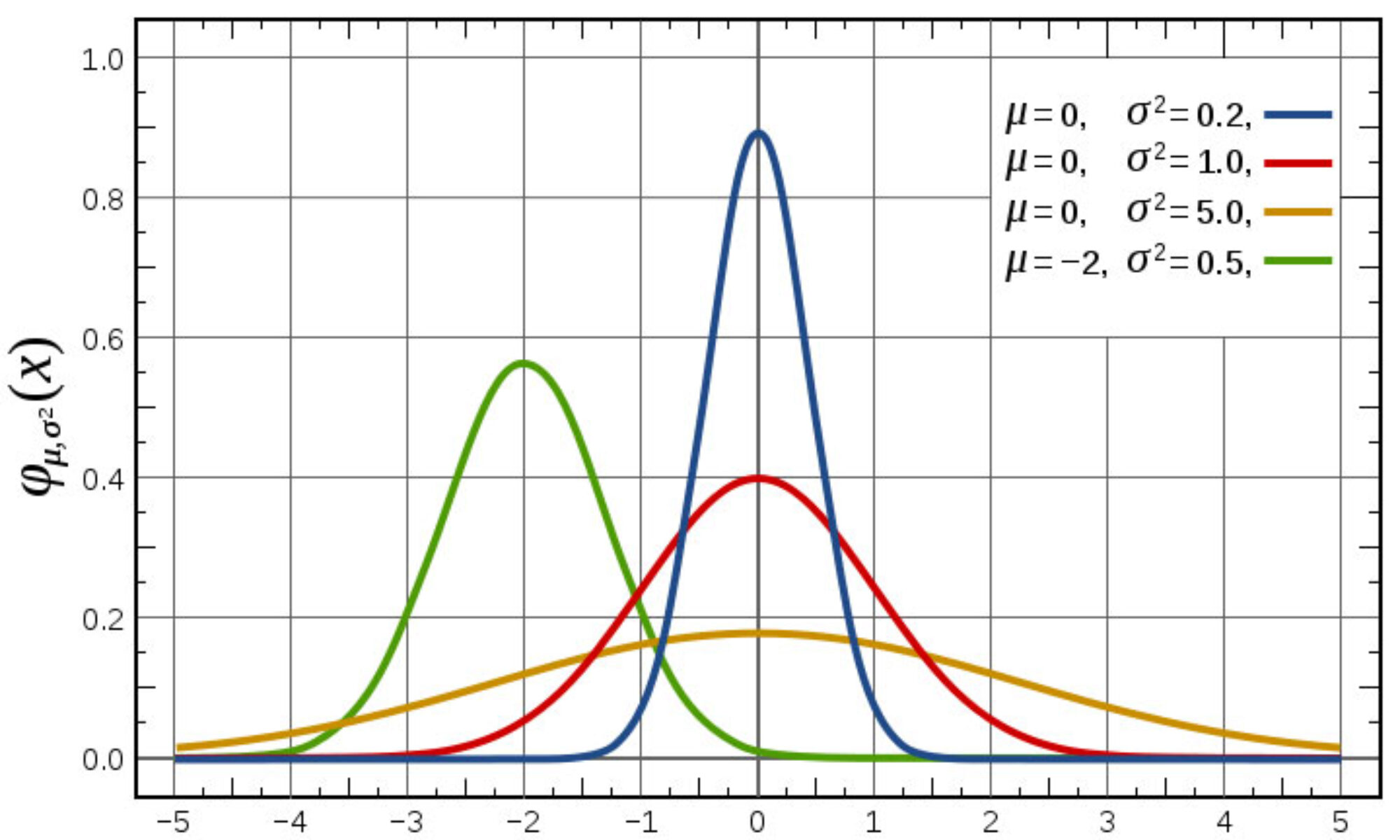

Since most topics covered in Finance 4366 presuppose a fundamental understanding and facility with algebra, differential calculus, and probability & statistics, the second class meeting in the Spring 2024 semester will incorporate a mathematics tutorial. Subsequently, the third and fourth class meetings will delve into probability and statistics.

The Khan Academy is an exceptional online resource for revisiting or acquainting oneself with these concepts. Below are my recommendations for specific Khan Academy videos covering the following topics:

- Algebra: Intro to the Binomial Theorem, Pascal’s Triangle and Binomial Expansion

- Calculus: Taking derivatives, Optimization (profit maximization) with calculus, Visualizing Taylor Series for e^x

- Probability and statistics: Basic probability, Compound, independent events, Permutations, Combinations, probability using combinatorics, Random variables and probability distributions, Binomial distribution, Law of Large Numbers, and Normal Distribution.

Lastly, if your algebra proficiency is somewhat rusty, I would also recommend exploring the Khan Academy’s algebra review for a comprehensive refresher.